Minimum Wage in Pennsylvania

In recent years, the debate over the federal minimum wage has ignited a fervent discussion across the United States. As of now, the federal minimum wage stands at $7.25 per hour, a rate that has not seen an increase since 2009. This stagnation has led to a growing disparity between the living wage and the minimum wage, prompting many states to take action.

Currently, 30 states have elevated their minimum wage above the federal baseline, reflecting a nationwide trend towards recognizing and addressing the need for wage growth. This movement is not just a matter of economics but also a response to the increasing public demand for a wage structure that aligns more closely with the current cost of living. The shift towards higher state minimum wages signals a significant transformation in how we approach the concept of a fair and livable income in the modern economy.

Amidst this evolving landscape, Pennsylvania finds itself at a crossroads. The Keystone State’s minimum wage mirrors the federal rate of $7.25 per hour, positioning it among the 20 states that have not surpassed this threshold. This static wage policy places Pennsylvania in stark contrast with its neighboring states, all of which have adopted higher minimum wages.

The state’s reluctance to adjust its minimum wage not only affects its low-wage workers but also poses broader economic and social challenges. As states around it progress towards more sustainable wage models, Pennsylvania faces increasing pressure to reevaluate its stance on minimum wage.

The state’s current position highlights a critical juncture in its economic policy-making, prompting a pivotal dialogue about the future of its workforce and the overall health of its economy in the context of national wage trends.

What is the Minimum Wage in Pennsylvania?

$11 per hour

In June, the Democratic majority in the Pennsylvania House approved a bill aimed at raising the state’s minimum wage. The proposed legislation outlined a gradual increase, starting at $11 in 2024, followed by $13 in 2025, and ultimately reaching $15 in 2026. A parallel bill with the same objectives was introduced in the state Senate.

Current State of Minimum Wage in Pennsylvania

Pennsylvania’s minimum wage currently aligns with the federal minimum, steadfastly set at $7.25 per hour. This synchronization with the federal rate places Pennsylvania in a group of states that have not taken independent legislative action to increase the minimum wage. While this congruence ensures compliance with national standards, it also highlights the state’s cautious approach to wage regulation.

The consistency between Pennsylvania’s state and the federal minimum wage simplifies wage guidelines for employers but raises questions about the adequacy of earnings for the state’s lowest-paid workers, especially when considering the rising cost of living and the economic pressures faced by individuals and families.

Historically, Pennsylvania’s journey with the minimum wage has been a tale of cautious adjustments and alignments with federal standards. Since the last federal increase in 2009, Pennsylvania has maintained the federal minimum wage rate, reflecting a period of wage stagnation that spans over a decade.

This historical reluctance to deviate from the federal baseline underscores a pattern of minimal state intervention in wage regulation. However, this consistency also sets the stage for potential shifts, as public discourse and legislative momentum build around the need for a more progressive wage policy that addresses the evolving economic landscape and the needs of the state’s workforce.

The percentage of workers earning the minimum wage or less in Pennsylvania provides a critical insight into the state’s wage landscape. While only about 1% of Pennsylvania workers earn the minimum wage or less, this statistic does not diminish the significance of the issue. The number represents a segment of the workforce that contends with the challenges of sustaining a livelihood on wages that have not kept pace with the rising cost of living.

This demographic, although a small fraction of the state’s workforce, symbolizes the broader implications of wage policies and the real-life impacts of maintaining a minimum wage that has not seen an increase in over a decade. The statistic serves as a benchmark in the ongoing discourse about the adequacy of the minimum wage and the economic well-being of Pennsylvania’s most vulnerable workers.

Legislative Attempts and Political Landscape

In recent years, Pennsylvania has witnessed a surge in legislative initiatives aimed at raising the minimum wage. Lawmakers, responding to the growing public outcry and the evident economic need, have introduced several bills to address this issue. Notably, the Pennsylvania House passed legislation proposing a progressive increase in the minimum wage, envisioning a gradual rise to $15 per hour by 2026.

This initiative reflects a broader movement within the state to align its wage policies with the rising cost of living and the economic realities faced by its workforce. Despite these efforts, the path to actualizing these legislative proposals remains complex, marked by robust debates and negotiations among lawmakers, indicating a legislative landscape that is both active and highly nuanced.

The Pennsylvania House and Senate play pivotal roles in shaping the state’s minimum wage policy. The legislative process involves both chambers, each bringing its perspectives and priorities to the table. The House, demonstrating responsiveness to public advocacy and economic data, has been instrumental in forwarding progressive wage legislation.

Conversely, the Senate’s role is more measured, often characterized by a thorough scrutiny of the implications of wage increases. The dynamic interplay between the House and the Senate embodies the checks and balances inherent in the legislative process, ensuring that any adjustment to the minimum wage is the product of comprehensive deliberation and bipartisan consensus.

Key political figures and stakeholders bring a spectrum of perspectives to the minimum wage discussion in Pennsylvania. State legislators, business leaders, labor advocates, and economists contribute to a multifaceted dialogue about the implications of raising the minimum wage. Political figures, often divided along party lines, weigh the economic benefits against potential business impacts.

Meanwhile, business leaders scrutinize the operational and competitive implications of wage increases, and labor advocates emphasize the urgent need for a living wage that reflects economic realities. This array of viewpoints ensures a vibrant and robust debate, underlining the complexity and significance of minimum wage policy in shaping Pennsylvania’s economic and social fabric.

Regional Comparison and Economic Implications

Pennsylvania’s minimum wage landscape starkly contrasts with the progressive wage policies of its neighboring states. While Pennsylvania adheres to the federal minimum of $7.25 per hour, states like Ohio, New York, New Jersey, Maryland, and Delaware have taken significant strides by setting higher minimum wage rates. For instance, New York and New Jersey have reached a $15 per hour mark, with Maryland and Delaware on track to meet this threshold soon.

This disparity not only highlights a regional divergence in wage policies but also sets the stage for potential economic repercussions, affecting labor markets and interstate business dynamics.

The variance in minimum wage rates across state borders presents profound implications for Pennsylvania’s economic competitiveness and workforce migration patterns. As neighboring states offer more attractive wage rates, Pennsylvania risks losing a segment of its workforce, particularly in industries that rely heavily on low-wage workers.

This outflow of labor can lead to a talent drain, making it challenging for Pennsylvania businesses to attract and retain employees. Furthermore, the state’s relative wage stagnation may deter businesses from investing or expanding in Pennsylvania, opting instead for neighboring states with more progressive wage policies. This dynamic underscores the intricate link between wage policies, labor market health, and broader economic vitality.

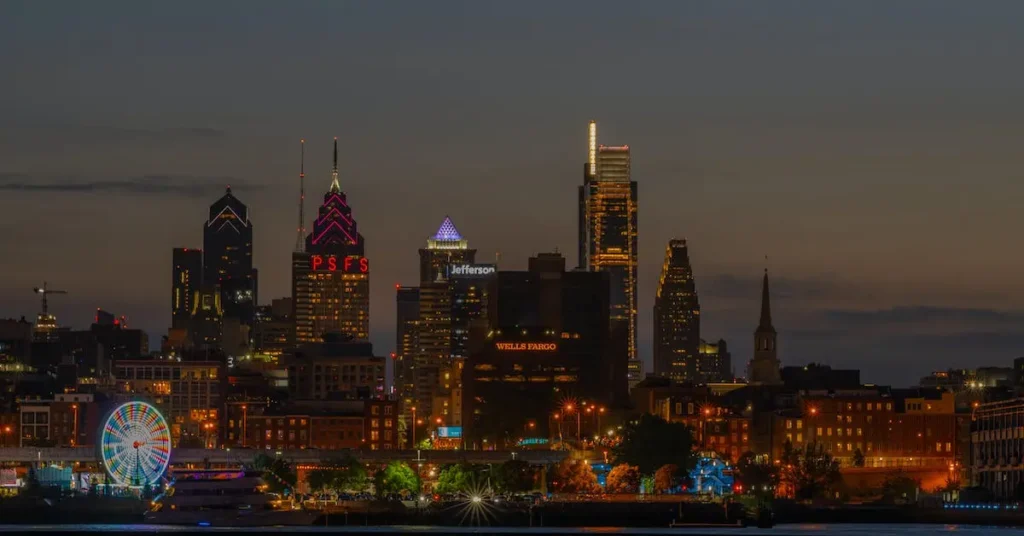

The cost of living within Pennsylvania exhibits notable variations, accentuating the complexities surrounding the minimum wage discourse. Urban centers like Philadelphia and Pittsburgh, known for their higher living costs, starkly contrast with the state’s rural areas, where the cost of living tends to be lower.

This geographic disparity in living expenses raises important questions about the adequacy of a uniform state minimum wage. In high-cost areas, the current minimum wage may fall short of providing a livable income, while in other regions, it might be relatively more sustainable.

Understanding these internal economic variations is crucial for crafting a minimum wage policy that is both fair and reflective of the diverse economic landscapes within the Keystone State.

Local Initiatives and Employer Practices

Cities like Philadelphia have taken a proactive stance in addressing the minimum wage issue, crafting local initiatives that seek to uplift the earnings of their lowest-paid workers. For instance, Philadelphia implemented a policy that incrementally raises the minimum wage for city workers, contractors, and subcontractors, reaching $15 per hour in recent years.

These local initiatives, often born out of the unique economic and social fabrics of the cities, underscore the potential of localized action in bridging the wage gap. They serve as case studies for how municipalities can tailor wage policies to reflect the specific needs and conditions of their communities, thereby fostering a more equitable economic environment.

Beyond legislative efforts, a notable shift in employer practices reflects a growing recognition of the importance of offering competitive wages. In Pennsylvania, many employers voluntarily raise their pay rates above the state minimum, acknowledging the benefits of attracting and retaining a motivated and stable workforce.

This trend is not confined to large corporations but is also evident among small businesses that see the value in investing in their employees. These employer-driven wage increases serve as a testament to the evolving landscape of wage standards, where market forces and ethical considerations converge to shape compensation strategies.

The private sector plays a pivotal role in shaping wage standards, often acting as a catalyst for change even in the absence of legislative action. Businesses, by adopting progressive wage practices, can drive market trends, setting benchmarks for industry standards and influencing the broader wage dialogue. This influence extends beyond their immediate workforce, affecting supply chain practices and consumer expectations.

The private sector’s approach to wage determination, whether through formal wage policies or through more subtle market dynamics, is a critical component in the broader discourse on fair compensation and economic sustainability. Recognizing and harnessing this potential is crucial for fostering a labor market that is both competitive and equitable.

Future Prospects and Ongoing Debates

The future of minimum wage in Pennsylvania hinges on a series of proposed legislative reforms. Recent bills advocating for a gradual increase to a $15 per hour minimum wage by 2026 have sparked intense discussions among lawmakers, businesses, and the public. The potential outcomes of these legislative efforts range from significant shifts in the state’s wage structure to more incremental adjustments.

The passage of such legislation could redefine the economic landscape of Pennsylvania, potentially improving living standards for low-wage workers and influencing the broader economy. The outcomes of these legislative endeavors will not only reflect the state’s economic priorities but also its commitment to addressing wage disparities and fostering a more inclusive economy.

The notion of tying the minimum wage to inflation and cost of living adjustments is at the forefront of the wage policy debate. Proponents argue that indexation to inflation would ensure that the minimum wage keeps pace with the rising cost of living, preserving the purchasing power of low-wage earners.

Opponents, however, express concerns about the potential impact on businesses, particularly small enterprises, fearing that automatic adjustments could lead to increased operational costs and economic instability. This debate encapsulates the broader challenge of balancing the need for a livable wage with the economic realities faced by employers, highlighting the complexities of crafting a wage policy that is both fair and sustainable.

The discourse surrounding the increase in the minimum wage encompasses a wide array of economic and social arguments. Proponents advocate for the raise, citing the benefits of reducing poverty, stimulating consumer spending, and promoting fair labor standards. They argue that a higher minimum wage could lead to a more equitable distribution of wealth and a more robust economy.

On the other hand, opponents caution against potential adverse effects, such as job losses, increased automation, and higher consumer prices. They emphasize the need for a balanced approach that considers the varying capacities of businesses to absorb wage hikes. This ongoing debate reflects the diverse perspectives and interests that shape the minimum wage discourse, underscoring the need for a nuanced and informed approach to policy-making in this critical area.

Navigating Minimum Wage Laws in Pennsylvania

Pennsylvania’s adherence to the federal minimum wage of $7.25 per hour sets the baseline for employers across the state. However, understanding the nuances of the state’s wage laws and regulations is crucial for compliance and informed decision-making. The Pennsylvania Minimum Wage Act extends beyond the mere dollar figure, encompassing a range of provisions including, but not limited to, overtime pay, exemptions, and record-keeping requirements.

Employers must navigate these regulations diligently to ensure they meet legal standards and uphold fair labor practices. Staying informed about legislative changes and potential adjustments to the minimum wage is also vital, as these can significantly impact wage structures and employer responsibilities.

Both employees and employers in Pennsylvania have a set of rights and responsibilities under the state’s minimum wage laws. Employees have the right to receive at least the minimum wage for every hour worked and are entitled to overtime pay for hours worked beyond the standard 40-hour workweek, unless specific exemptions apply.

Employers, on the other hand, are responsible for adhering to these wage laws, maintaining accurate records of hours worked and wages paid, and ensuring timely and fair compensation. Understanding these rights and responsibilities is paramount in fostering a transparent and equitable work environment. Both parties are encouraged to engage in open communication and to seek clarity on any aspects of wage laws that may be unclear or subject to interpretation.

Navigating minimum wage laws can be complex, and accessing reliable resources is key for both employees and employers seeking guidance or clarification. The Pennsylvania Department of Labor & Industry serves as a primary source of information, offering detailed guidelines, updates on wage laws, and resources for compliance.

Additionally, legal assistance is available through various channels for those requiring more personalized guidance or facing specific legal issues related to wage laws. Legal aid organizations, employment law attorneys, and even industry associations can provide valuable support and representation. Staying informed and seeking expert advice when necessary empowers both employees and employers to navigate Pennsylvania’s minimum wage laws effectively and confidently.

Conclusion

Pennsylvania currently stands at a pivotal juncture in its approach to minimum wage policies. With its adherence to the federal minimum wage rate of $7.25 per hour, the state maintains a stance that is both conservative and reflective of a cautious approach to wage legislation.

However, the winds of change are evident in the legislative efforts underway, proposing progressive increases that could eventually elevate the minimum wage to $15 per hour by 2026. These proposed changes signal a potential shift in the state’s economic and social landscape, promising to reshape the fabric of the workforce and the livelihoods of countless Pennsylvanians. As the dialogue unfolds and the legislative process continues, the state’s stance on minimum wage remains a topic of keen public interest and critical economic significance.

The debate over minimum wage policies extends far beyond the realm of economics, touching the very core of societal values and the principles of equity and fairness. The implications of these policies ripple through the fabric of society, influencing the quality of life, social mobility, and the dignity of work. A fair and livable minimum wage can empower individuals, reduce poverty levels, and stimulate economic growth through increased consumer spending.

Conversely, the absence of a robust minimum wage policy can perpetuate income disparities and hamper the economic potential of a significant portion of the workforce. As Pennsylvania navigates its path forward, the decisions made about minimum wage policies will not only shape the economic landscape but also reflect the state’s commitment to fostering a society that values the contributions of every worker and ensures that the prosperity of the economy is shared more equitably among its citizens.